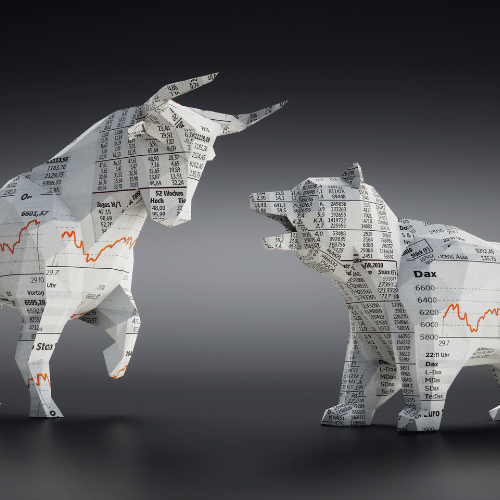

Trading Bank Nifty, like trading any other financial instrument, requires a well-thought-out strategy that suits your risk tolerance, objectives, and market conditions. Here are some common strategies you can consider for trading Bank Nifty:

- Day Trading:

- Scalping: Traders aim to make small profits from frequent, quick trades. They often use short-term charts and technical analysis to identify short-lived price movements.

- Intraday Trend Following: This strategy involves identifying the prevailing trend for the day (upward or downward) and trading in the direction of that trend.

- Swing Trading:

- Swing trading is a strategy where traders aim to profit from the medium-term price swings in the Bank Nifty Index. They typically hold positions for several days or even weeks.

- Technical Analysis: Swing traders often rely on technical indicators, chart patterns, and support/resistance levels to make trading decisions.

- Options Trading Strategies:

- Covered Call: Investors buy Bank Nifty stocks and sell call options against those stocks to generate additional income.

- Protective Put: Investors buy Bank Nifty stocks and buy put options to protect against potential downside risk.

- Straddle and Strangle: These strategies involve buying both call and put options to profit from significant price volatility, regardless of the direction.

- Breakout Trading:

- Breakout traders look for instances when the Bank Nifty Index breaks out of a well-defined trading range. They aim to capture rapid price movements that often follow a breakout.

- Trend Trading:

- Trend traders aim to profit from the sustained directional movement of Bank Nifty. They enter long positions in an uptrend and short positions in a downtrend.

- Pairs Trading:

- Pairs trading involves trading the Bank Nifty against another related index or asset, such as the Nifty 50. Traders look for relative strength or weakness between the two instruments and take positions accordingly.

- Arbitrage:

- Arbitrage traders seek to profit from price differences of Bank Nifty and its derivative products, such as Bank Nifty futures or options, in different markets or exchanges. This strategy requires fast execution and low latency.

- News-Based Trading:

- Traders can react to significant news events or economic data releases that may impact the banking sector and Bank Nifty. Quick decision-making and risk management are crucial in this strategy.

- Volatility Trading:

- Traders who anticipate increased market volatility can employ strategies such as straddles or strangles to benefit from large price swings.

- Quantitative Trading:

- Quantitative traders use algorithms and mathematical models to identify trading opportunities based on historical data, technical indicators, and statistical analysis.

Key Tips for Trading Bank Nifty:

- Risk Management: Always define your risk tolerance and use stop-loss orders to limit potential losses.

- Diversify: Avoid putting all your capital into a single trade or strategy. Diversification can help spread risk.

- Stay Informed: Keep abreast of financial news, economic indicators, and events that can influence the banking sector and Bank Nifty.

- Paper Trading: If you’re new to trading or testing a new strategy, consider paper trading (simulated trading) to practice without risking real money.

- Backtesting: Before implementing a strategy, backtest it on historical data to evaluate its performance under various market conditions.

- Continuous Learning: The financial markets are dynamic, so keep learning and adapting your strategies to changing market conditions.

Remember that no trading strategy is foolproof, and there are always risks involved. It’s essential to have a clear plan, risk management rules, and the discipline to stick to your strategy, even in volatile markets. Additionally, consider seeking advice from financial professionals or conducting thorough research before trading Bank Nifty or any other financial instrument.