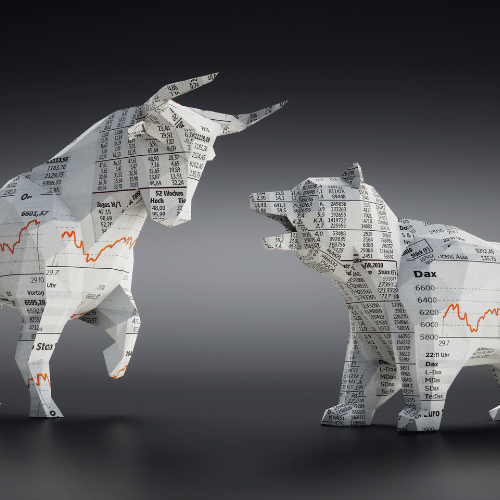

Nifty futures and options are popular derivatives instruments that allow traders and investors to speculate on or hedge against the price movements of the Nifty 50 Index. These derivatives are traded on the National Stock Exchange (NSE) of India. Let’s explore Nifty futures and options trading, including what they are, how they work, and some strategies you can use:

Nifty Futures Trading:

What are Nifty Futures?

Nifty futures are financial contracts that obligate the buyer to purchase and the seller to sell the Nifty 50 Index at a predetermined price (known as the futures price) on a specified future date. These contracts enable traders to bet on the future direction of the Nifty Index.

How Nifty Futures Work:

- Contract Specifications: Nifty futures contracts have predefined sizes, expiry dates (usually monthly), and lot sizes. The lot size represents the quantity of Nifty Index units in one contract.

- Long and Short Positions: Traders can take either a long position (buy) if they anticipate the Nifty Index will rise or a short position (sell) if they expect it to fall.

- Margin Requirements: Futures trading involves margin requirements, which are a fraction of the contract’s value. Traders must maintain sufficient margin in their trading accounts to cover potential losses.

- Profit and Loss: Profits and losses in Nifty futures trading depend on the price movement of the Nifty Index relative to the futures price. If the index moves in the direction favorable to the trader’s position, they make a profit; otherwise, they incur losses.

Nifty Options Trading:

What are Nifty Options?

Nifty options are financial contracts that provide the buyer with the right (but not the obligation) to buy (call option) or sell (put option) the Nifty 50 Index at a specified price (strike price) on or before a predetermined future date (expiration date).

How Nifty Options Work:

- Call Options: Buyers of call options profit if the Nifty Index rises above the strike price before the expiration date. Sellers (writers) of call options hope the index doesn’t exceed the strike price.

- Put Options: Buyers of put options profit if the Nifty Index falls below the strike price before the expiration date. Sellers (writers) of put options hope the index remains above the strike price.

- Contract Specifications: Nifty options have predefined strike prices, expiration dates, and lot sizes. Traders can choose from various strike prices and expiration dates to suit their strategies.

- Premium: The premium is the price paid for an option contract. It’s the cost of buying or selling the option.

- Profit and Loss: Option traders’ profits and losses depend on the difference between the option’s market price and the eventual settlement price of the Nifty Index. Option trading allows for various strategies, including hedging, speculating, and generating income.

Nifty Futures and Options Strategies:

- Hedging: Use futures and options to hedge an existing stock portfolio against market downturns.

- Speculation: Bet on the future direction of the Nifty Index using futures or options based on your market outlook.

- Income Generation: Employ strategies like covered calls (writing call options against a stock position) to generate income from your holdings.

- Arbitrage: Take advantage of price discrepancies between the Nifty Index, Nifty futures, and Nifty options to lock in risk-free profits.

- Strategies Combining Futures and Options: Complex strategies such as straddles, strangles, and spreads involve both futures and options positions and are used to profit from volatility or specific price movements.

- Delta Hedging: Hedge option positions by trading Nifty futures to offset price movements.

- Iron Condor and Butterfly Spreads: These are options strategies involving multiple call and put options with different strike prices, used to benefit from limited volatility.

Before engaging in Nifty futures and options trading, it’s crucial to understand the risks involved, have a well-thought-out strategy, and consider factors like volatility, time decay, and margin requirements. Additionally, make use of stop-loss orders to manage risk and consider paper trading or practicing with smaller positions if you’re new to derivatives trading.