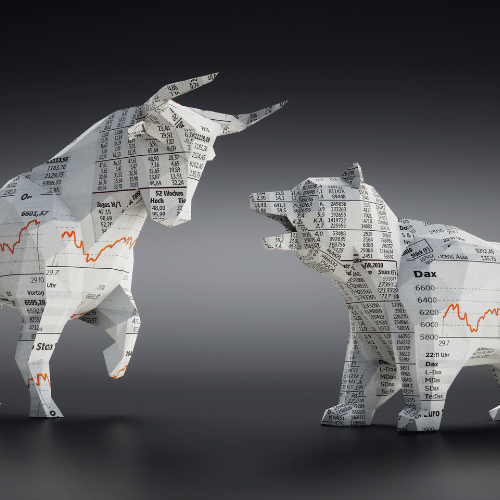

Nifty and Bank Nifty are two prominent indices in the Indian stock market, each with its own unique characteristics and composition. Here are the key differences between Nifty and Bank Nifty:

1. Composition:

- Nifty: The Nifty 50, often referred to as Nifty, is a broad-based stock market index that comprises the 50 largest and most liquid stocks listed on the National Stock Exchange (NSE) of India. It represents a diverse range of sectors, including information technology, banking, pharmaceuticals, automotive, consumer goods, energy, and more. Nifty is a reflection of the overall Indian equity market.

- Bank Nifty: Bank Nifty, on the other hand, is a sectoral index that focuses exclusively on banking and financial services stocks. It includes the most liquid and actively traded banking and financial sector companies listed on the NSE. Bank Nifty’s constituents are primarily banks, financial institutions, and related companies.

2. Sectoral Focus:

- Nifty: Nifty provides a broad overview of the Indian equity market and includes companies from various sectors. It is not limited to any specific industry.

- Bank Nifty: Bank Nifty is sector-specific and concentrated solely on the banking and financial sector. This makes it more sensitive to developments and news related to the financial industry, making it a preferred index for traders and investors with specific interests in banking stocks.

3. Impact of Economic Factors:

- Nifty: The performance of Nifty is influenced by a wide range of economic factors, including overall economic growth, inflation, government policies, and global economic trends. It reflects the overall market sentiment in India.

- Bank Nifty: Bank Nifty is particularly sensitive to events and factors that affect the banking sector, such as changes in interest rates, monetary policy decisions by the Reserve Bank of India (RBI), non-performing assets (NPAs), and financial regulations. Economic events that primarily impact banks can have a significant effect on Bank Nifty.

4. Volatility:

- Nifty: Due to its diversification across multiple sectors, Nifty is often considered less volatile than Bank Nifty. It may exhibit more stable and gradual price movements compared to Bank Nifty.

- Bank Nifty: Bank Nifty can experience higher volatility, especially during financial sector-specific events or policy announcements. Changes in interest rates or banking sector reforms can lead to sharp price swings in Bank Nifty.

5. Investment and Trading Objectives:

- Nifty: Investors and traders looking for a diversified exposure to the Indian equity market often track or invest in Nifty. It is suitable for those seeking a broader view of the overall market.

- Bank Nifty: Investors and traders with a specific interest in the banking and financial sector may prefer to focus on Bank Nifty. It allows them to capitalize on opportunities and challenges within this sector and tailor their strategies accordingly.

In summary, Nifty and Bank Nifty cater to different investment and trading objectives. Nifty is a comprehensive benchmark for the broader Indian equity market, while Bank Nifty is a specialized index that provides insights into the performance of the banking and financial sector. Understanding their differences can help investors and traders make informed decisions based on their specific goals and market outlook.