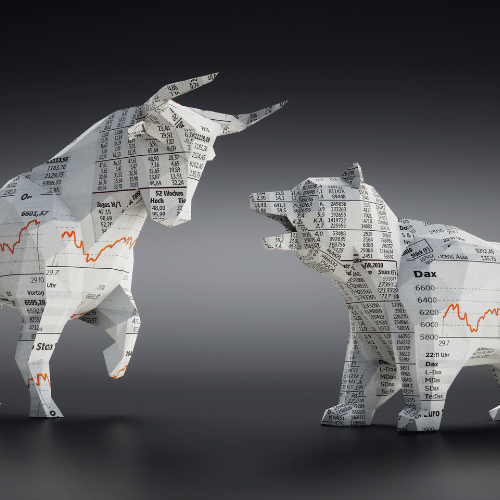

To comprehend the Bank Nifty Index fully, it’s essential to dive into its individual components. This sectoral index comprises the most influential and actively traded banking stocks listed on the National Stock Exchange (NSE) of India. In this article, we’ll explore some of the key constituents of Bank Nifty and gain insight into their significance within the index.

1. State Bank of India (SBI)

About: State Bank of India (SBI) is one of the largest and oldest commercial banks in India. It’s a public sector bank known for its extensive branch network and diverse financial services.

Significance: As the largest bank in India, SBI carries substantial weight within Bank Nifty. Its performance often mirrors the overall health of the banking sector and the Indian economy.

2. HDFC Bank

About: HDFC Bank is a prominent private sector bank in India, known for its efficient services, digital banking, and wide customer base.

Significance: HDFC Bank is a heavyweight in Bank Nifty and is closely watched by investors and analysts for its potential impact on the index’s movements.

3. ICICI Bank

About: ICICI Bank is another major private sector bank in India, offering a range of financial products and services to individuals and businesses.

Significance: As one of the largest private banks, ICICI Bank’s performance influences the direction of Bank Nifty. Its inclusion reflects the importance of private banks in the Indian financial landscape.

4. Kotak Mahindra Bank

About: Kotak Mahindra Bank is a leading private sector bank known for its innovative banking solutions and strong customer focus.

Significance: This bank plays a crucial role in Bank Nifty, representing the newer generation of private banks that have gained prominence in recent years.

5. Axis Bank

About: Axis Bank is a private sector bank known for its extensive network of branches and a wide range of financial services.

Significance: Axis Bank’s presence in Bank Nifty showcases the contributions of various private sector banks to the index’s overall performance.

6. IndusInd Bank

About: IndusInd Bank is a private sector bank recognized for its emphasis on customer service and digital banking.

Significance: This bank adds diversity to Bank Nifty, reflecting the unique strengths of different private sector players.

7. Bank of Baroda

About: Bank of Baroda is a prominent public sector bank with a substantial international presence.

Significance: As a major public sector bank, Bank of Baroda brings stability and public sector representation to Bank Nifty.

8. Punjab National Bank (PNB)

About: Punjab National Bank is one of India’s oldest and largest public sector banks, with a wide-ranging portfolio of financial services.

Significance: PNB’s inclusion in Bank Nifty reflects the significance of established public sector banks in the index.

These are just a few of the key components of the Bank Nifty Index. It’s important to note that Bank Nifty includes additional banking and financial sector stocks, each contributing to the index’s performance in its own way. Understanding the individual strengths and weaknesses of these components is essential for investors and traders looking to navigate the dynamic landscape of the Indian banking sector and make informed decisions within the market.